Indonesia’s foreign capital outflow recorded at 403.6 mln USD in last week of September

Bagikan

Komentar

Berita Terkait

Feature - Innovation, social media become NAVAKA's steps to develop furniture business

Indonesia

•

16 Oct 2024

Indonesia-UNIDO’s SMART Fish project increases fishery production

Indonesia

•

12 Nov 2020

Indonesia's foreign debt in Q2 falls to 403.0 bln USD

Indonesia

•

15 Aug 2022

International Energy Agency launches World Energy Investment 2020 on Indonesia

Indonesia

•

04 Aug 2020

Berita Terbaru

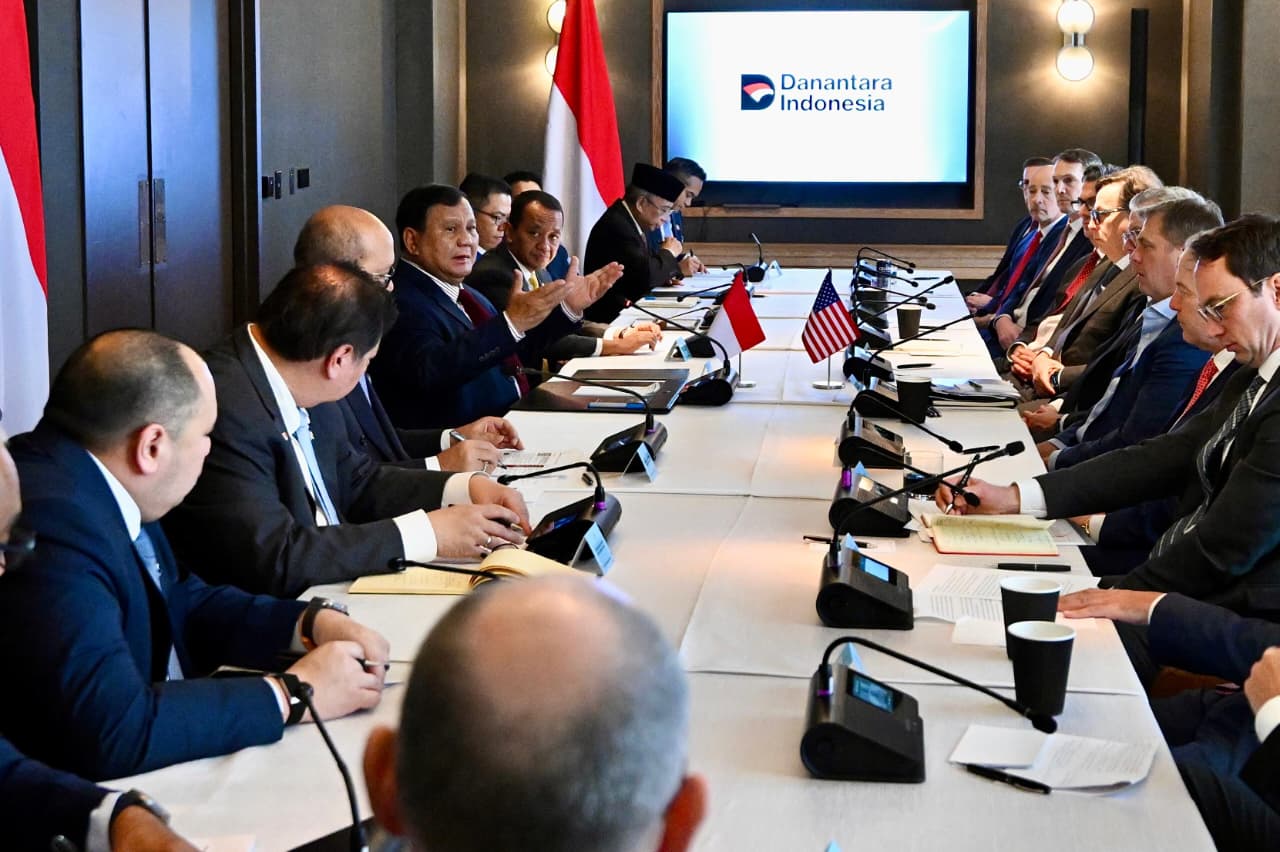

Indonesian president meets 12 Global CEOs in Washington, D.C.

Indonesia

•

22 Feb 2026

Indonesian President, British PM agree on New Indonesia-UK Strategic Partnership

Indonesia

•

21 Jan 2026

Algeria, Indonesia sign MoU to strengthen cooperation in phosphate sector

Indonesia

•

21 Jan 2026

Indonesia emphasizes private sector’s strategic role in accelerating accession process to OECD

Indonesia

•

20 Jan 2026