Jakarta (Indonesia Window) – The World Bank has assessed that Indonesia's financial sector is currently still vulnerable to global risks, relatively small, and expensive, making this a structural deficiency that hinders the development of the sector.

"However, the Indonesian financial sector has demonstrated solid macro-financial fundamentals during the COVID-19 pandemic," Satu Kahkonen, Head of the World Bank’s Representative for Indonesia and Timor-Leste, said at the launch of the 'Indonesia Economic Prospects June 2022' report which was monitored online here on Wednesday.

Under such circumstances, according to her, policy makers have three opportunities to overcome the risks and constraints that exist in the financial sector in Indonesia.

The first opportunity is to increase the supply and demand of the financial sector which requires expansion of funding sources. This can be done by growing the institutional investor base and ensuring access to digital financial services.

This will enable the borrowing and use of financial services, and will facilitate the development of new green financial instruments to support the low-carbon transition, Kahkonen explains.

The second opportunity is to increase the allocation of resources through the financial sector.

Extensive digital financial services, promotion of competition in the banking sector, and the establishment of a sound financial infrastructure are the keys that can help channel savings into the most productive investments in a cheaper, faster, safer and transparent way, Kahkonen said.

Meanwhile, the third opportunity that policy makers in Indonesia have is strengthening the capacity of the financial sector to withstand financial and non-financial shocks.

This step is important for the financial sector to allocate resources efficiently, assess and manage risks, and support the real sector which is the task of the financial sector.

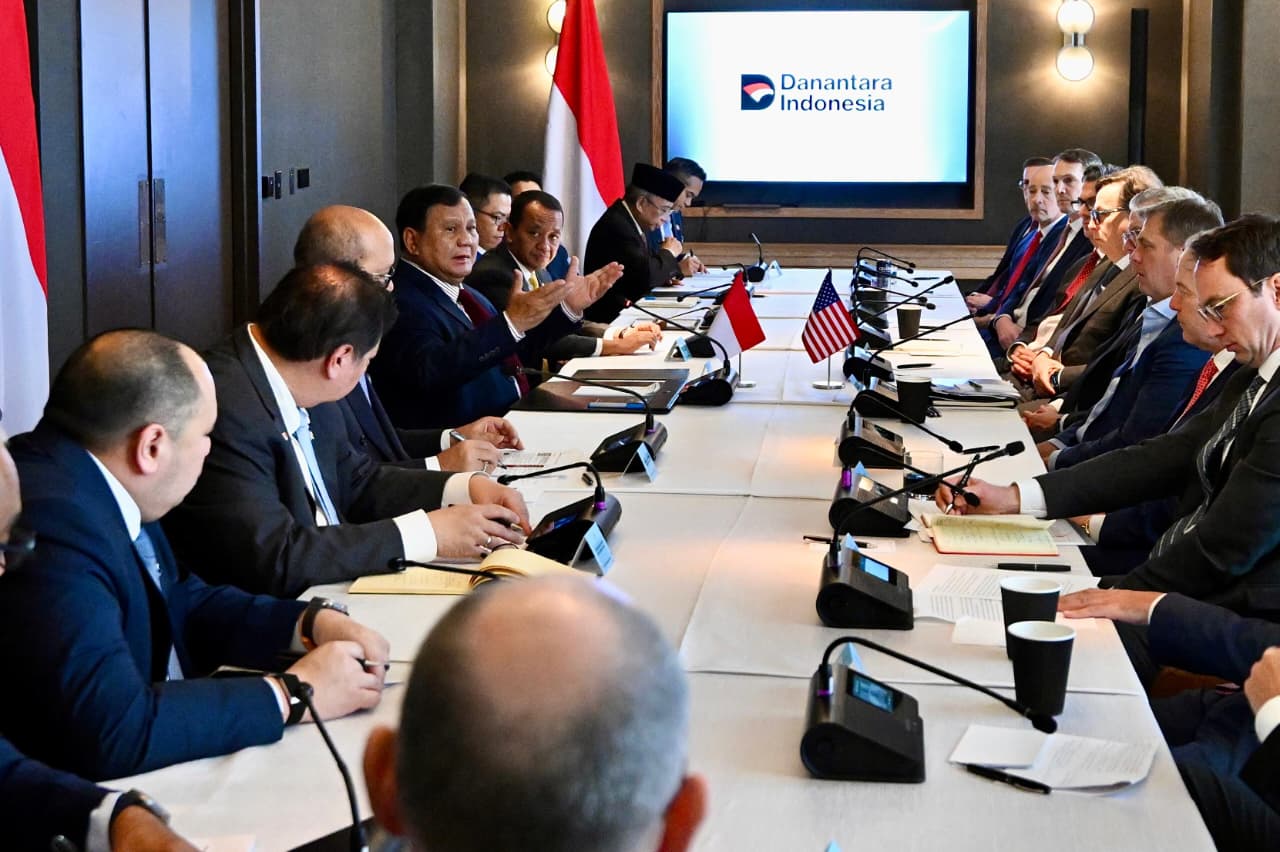

Illustration. Policy makers in Indonesia are expected to strengthen the capacity of the financial sector to withstand financial and non-financial shocks. (Mohamad Trilaksono from Pixabay)

Financial regulatory strengths including integrated oversight and legal protection of supervisors, as well as crisis preparedness and resolution frameworks are important to ensure the financial sector stability in Indonesia.

Kahkonen further said shocks related to climate that are very possible to occur in Indonesia can also pose risks to the financial sector stability and require adequate risk management.

To operationalize these three opportunities, reforms need to focus on increasing depth and efficiency, as well as strengthening the resilience of the financial system.

In a modern economy, the financial sector is considered the backbone of the expansion of economic activities. If it is not addressed immediately, it would drag the economic growth," she said.

Source: AntaraReporting by Indonesia Window