Indonesia records foreign capital outflow of 1.5 bln USD in 2nd week of March

Bagikan

Komentar

Berita Terkait

Indonesia targets 60 mln MSMEs connected to digital platforms in three years

Indonesia

•

14 Aug 2021

Indonesia, Japan explores digital startup partnership

Indonesia

•

27 Nov 2020

Indonesian, Singaporean central banks extend bilateral financial agreement

Indonesia

•

06 Nov 2021

Indonesia’s coal price recorded highest in decade at 115.35 USD per ton in July

Indonesia

•

07 Jul 2021

Berita Terbaru

China ramps up consumption push as policy priorities set through 2030

Indonesia

•

08 Mar 2026

Realistic growth target shows China's economic resilience, strategic resolve

Indonesia

•

06 Mar 2026

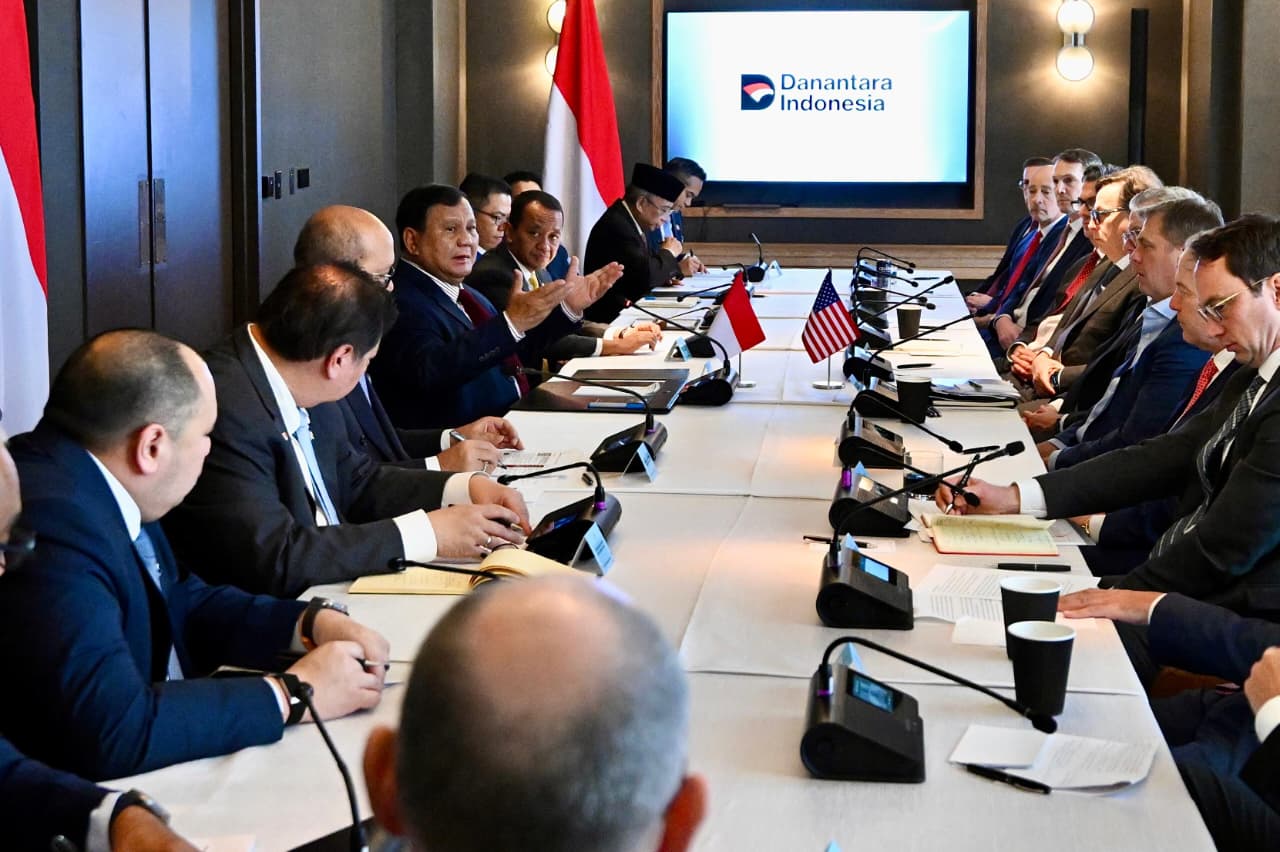

Indonesian president meets 12 Global CEOs in Washington, D.C.

Indonesia

•

22 Feb 2026

Indonesian President, British PM agree on New Indonesia-UK Strategic Partnership

Indonesia

•

21 Jan 2026